As state pension funds pull back from companies that profit from immigration detention, one New Jersey fund has sunk nearly a million dollars into the industry.

According to U.S. Securities and Exchange Commission filings, the NJ State Employees’ Deferred Compensation Plan purchased 18,000 shares of CoreCivic stock and 20,000 shares of Geo Group stock. The total investment was $964,000, a small portion of the entire fund, worth $559 million.

According to SEC filings, the shares were purchased sometime between June 30 and Aug. 2, around the height of the “zero tolerance” policy period. Geo Group runs Delaney Hall Detention Facility in Newark and CoreCivic runs Elizabeth Detention Center, a low slung building in Elizabeth that houses about 300 detainees and an immigration court. A page on the state’s website says Prudential Financial manages the fund.

The N.J. Treasury, Governor’s office and the State Comptroller did not respond to requests for comment.

In 2017, New York City became the first municipality to divest from the private prison industry. City Comptroller Scott Stringer announced his office was divesting the city’s five pension funds – a total value of $194 billion – from all private prison corporations it was invested in. State Comptroller Thomas DiNapoli announced he was divesting the New York State Common Retirement Fund from private prison corporations last month. However, in the most recent filings from the fund, the state has over $6 million still invested in Geo Group and CoreCivic.

The NJ State Employees Deferred Compensation Plan is a voluntary tax-deferral program meant to supplement public employees’ basic retirement plan.

Other cities and states have followed in removing public retirement funds from private prison stock. Philadelphia sold $1.2 million last October. Nashville, Tenn., has also moved to sell its holdings. Other cities like Cincinnati, Ohio, Portland, Ore. and Minneapolis have either divested or moved towards it. Universities like Columbia, Princeton and Stanford have active student divestment movements.

In August 2016, then Deputy Attorney General Sally Yates announced the Federal Bureau of Prisons was fading out the use of private prisons across America. Geo Group stock plummeted 35 percent in less than a month. CoreCivic stock fell about 41 percent in the same time period.

After Donald Trump was elected, the Justice Department reversed that decision; Geo Group stock grew about 60 percent in three months and CoreCivic’s stock shot up 80 percent. When the New York City funds sold the stock from Geo Group, stock prices were among the highest they had ever been.

In recent conference calls with analysts, leaders of Geo Group and CoreCivic were quick to distance themselves from the family separation policies of the Trump administration but also indicated both of their businesses were flourishing from contracts with the federal government, including U.S. Immigration and Customs Enforcement.

“We’ve seen a steady increase in our ICE populations throughout the country, and we expect this trend to continue as ICE seeks additional capacity,” David Donahue, president of GEO Group Corrections & Detention, said during an Aug. 4 conference call.

“ICE is actively pursuing additional capacity as agency’s projected continued growth and their detention capacity needs,” said Damon Hininger, president and chief executive officer of CoreCivic.

During the calls, the heads of both companies said they had received contracts with the federal government to expand the capacity of immigration detention facilities across the country. A Georgia facility expanded over 40 percent to 1,118 beds. Aurora ICE Processing Center in Colorado added 128 beds. One facility in Texas is slated to bring in $44 million in annualized revenue. And, the companies are expecting the windfall to continue.

“ICE is actively seeking out additional capacity because of the increased illegal crossings, and we expect that trend to continue,” said George Zoley, chairman and chief executive officer of Geo Group.

Socially responsible investing is a growing field, according to Joe Sinha, Chief Marketing Officer from Parnassus Investments, an investment fund in San Francisco that manages $27 billion. Parnassus is an “environmental, social and governance” firm, that only invests in companies it deems to have values and practices that align with their own, Sinha said in an interview.

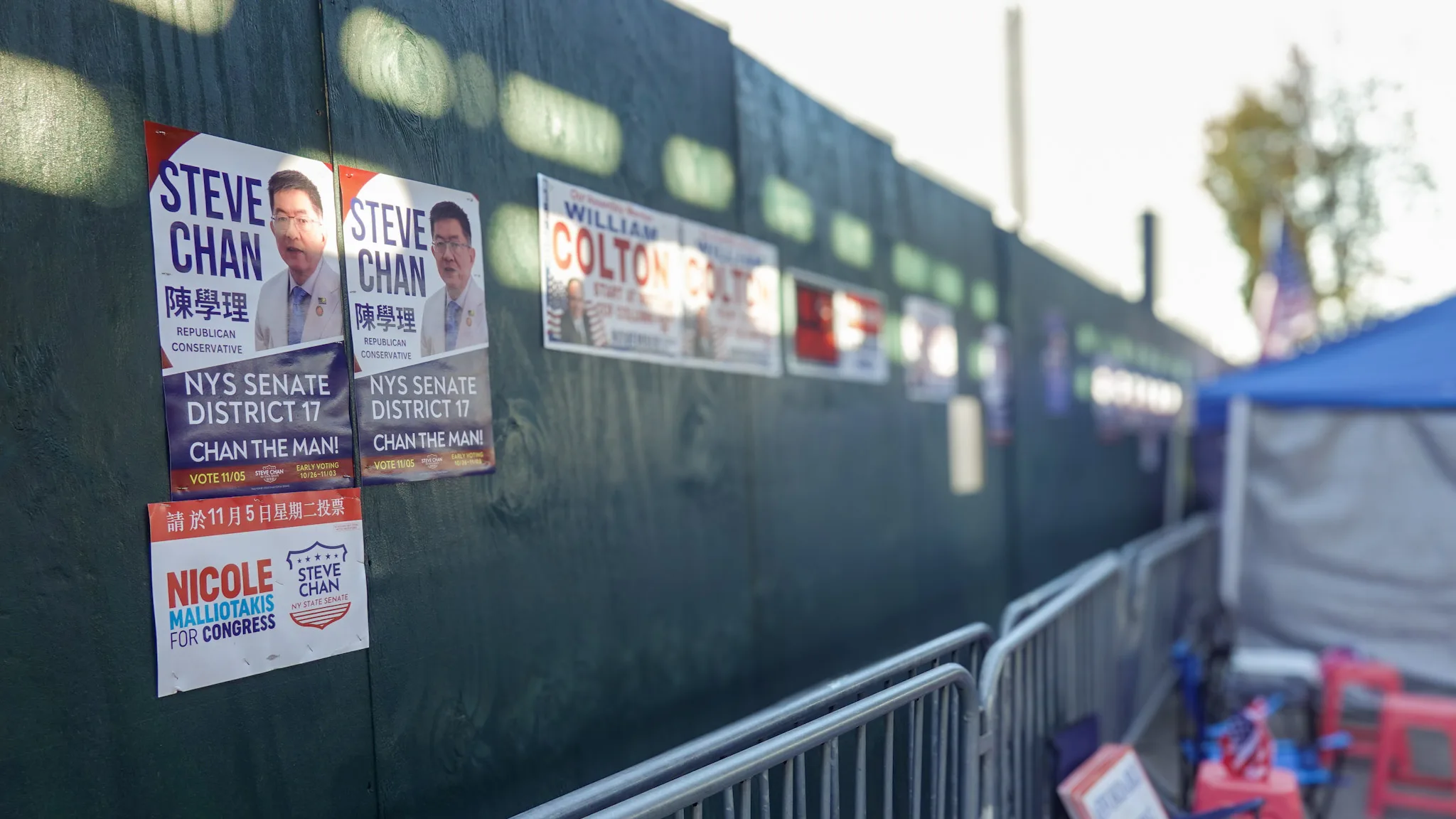

陈学理胜选凸显华人社区“右转”

“We would not invest in private prisons,” he said. “We don’t feel that they’re furthering society’s goals and our investors would not be pleased with us.”

Investors – large and small – have started to pay more close attention to the practices of the companies they support, Sinha said. He pointed to companies like Uber and Wells Fargo as examples of businesses that fluctuate in value after scandals about moral issues, not only business practices. While a $500,000 investment is insignificant to a $1.7 billion company like CoreCivic, Sinha said recent examples show that compounding investor unhappiness with a company can chip away at its value.

New Jersey advocates for immigrants have criticized county governments for signing lucrative contracts with ICE to house immigration detainees in local jails. Essex County was paid an average of $2.75 million per month in 2018, according to WNYC. Hudson and Bergen counties both received over $1 million per month in 2018. In the past three years, the county’s revenue from immigrant detainees has shot up 111 percent from $4.2 million to $8.9 million.

The managers of the NJ State Employees’ Deferred Compensation Plan soured on the stock, selling 36,000 shares between late 2017 and the end of June 2018. During that time, the fund didn’t own any CoreCivic stock.