This article was co-published with THE CITY.

For nearly a decade, Jean Xie recalled making it a habit to search online for two things: “Fresh Meadows Hotel” and “New York City.”

A resident of Shenzhen in China, Xie had become an investor in the Mayflower International Hotel Group’s Fresh Meadows Hotel EB-5 program which allowed foreign investors to obtain U.S. green cards by investing in U.S. businesses creating jobs. In this case, the hotel was an EB-5 regional center: an authorized United States Citizenship and Immigration Services (USCIS) intermediary, which allows the pooling of funds from multiple investors to finance larger projects through the program.

Hoping to secure a green card for her son, in 2015, Xie made a $500,000 investment in the Mayflower’s Fresh Meadows Hotel project. She had mortgaged her two-bedroom apartment in Shenzhen and wired $550,000 to Hubei Mayflower Industry and Commerce Group. Her money covered the minimum $500,000 investment and $50,000 in legal fees, translation fees and project issuance fees. Xie’s son signed a contract with Mayflower group, which was the first step in getting his EB-5 visa.

Hubei Mayflower then transferred her money to the Mayflower Regional Center’s bank account, according to emails, financial documents and contracts reviewed by Documented.

Two years later, in the winter of 2017, the Mayflower Group celebrated the opening of the Fresh Meadows Hotel in Queens. However, across the world in Shenzhen, Xie said she remained completely in the dark as the company provided minimal updates on the project’s financial status. The promised two-year deadline to receive her son’s green card was approaching, and she was still waiting for any news from Mayflower.

In the years following the completion of the Fresh Meadows Hotel, she continued her online searches until this June, while browsing through WeChat one afternoon, she stumbled upon an investigation co-published by Documented, THE CITY and The Guardian. It revealed a name she had never encountered before, along with numerous financial details about the project — information she said she had long sought but never received from the Mayflower Group.

Weihong Hu, a Chinese businesswoman and developer behind the Fresh Meadows Hotel under the Mayflower Regional Center, had secured $6 million in guaranteed annual rental income and special favors from Mayor Eric Adams’ administration after making significant contributions to his campaign.

The investigation revealed “a mutually beneficial relationship” between Mayor Adams and Weihong Hu, “an ambitious hotel operator who bundled tens of thousands of dollars in campaign checks” for Adams’ mayoral campaign. Subsequently, the investigation revealed, Hu had “scored behind-the-scenes benefits and millions in contract dollars from his administration.”

Xie felt a chill down her spine. She read the Chinese version of the story multiple times, trying to grasp every detail. It was financial news that, according to Xie, she had long sought from the Mayflower Group but never received. As she tried to process the article’s details, one question kept lingering: “Where has my money gone?”

A ‘good’ investment

Although Congress established the EB-5 Immigrant Investor Program in 1990, it didn’t gain popularity until after the 2008 financial crisis, particularly in the real estate development sector, as it provided an alternative financing option. Investors from Mainland China have consistently made up a significant proportion of EB-5 participants, according to data from the Department of State.

The Hudson Yards megaproject, the most expensive real estate development in U.S. history, secured at least $1.2 billion from EB-5 investors to help finance its construction. But it recently became embroiled in disputes with EB-5 investors from China over repayment delays.

Under the EB-5 program administered by USCIS, investors, along with their spouses and unmarried children under 21, can apply for lawful permanent residence by making a qualifying investment in a U.S. commercial enterprise and creating or preserving 10 permanent full-time jobs for qualified U.S. workers. USCIS also requires EB-5 investments to remain “at risk” throughout the investor’s conditional residency period to ensure the capital is actively used for job creation, which means EB-5 investors cannot receive a guaranteed refund or predetermined interest.

According to Xie, reading the investigation about Hu and Mayor Adams helped her resolve many questions, doubts, and frustrations she had faced over the years. It ultimately prompted her to expose the program to the media after realizing she had been misled and kept in the dark about key information regarding the project as an investor.

Even today, Xie still clearly remembers how she felt nearly a decade ago signing the contract for the Mayflower Fresh Meadows Hotel EB-5 project.

Xie first came across information about the Fresh Meadows Hotel project on a Chinese website in May 2015. Interested to learn more, she contacted the Wuhan-based company behind the project, Hubei Mayflower Industry and Commerce Group Co.

She was directed to Chunan Luo, the general manager of the Mayflower Hotel Wuhan and the key figure responsible for recruiting Chinese investors on behalf of Weihong Hu for the company’s EB-5 Regional Center program.

Established by Congress in 1992 as a temporary pilot program, the regional center program has become the main route for EB-5 investors since 2008, accounting for nearly all EB-5 investments today, partly due to its lower entry threshold and cost-effectiveness.

At that time, the EB-5 Regional Center Program had already drawn significant interest from those in China’s wealthy or middle class because of the special access it provided for immigrating to the U.S. Still, after learning that the program’s minimum investment was $500,000, Xie hesitated and even considered backing out as it was a significant amount for her family.

Luo then demonstrated his great skills of persuasion, Xie said, who noted that he was friendly and kind, even going so far as to personally deliver mooncakes to her from another city during the Mid-Autumn Festival as a sincere gesture. More importantly, he understood a mother’s desire to help her son.

After learning Xie’s son was studying in the U.S., Xie said Luo strongly recommended she invest in the company’s Fresh Meadows Hotel EB-5 program. The investment would serve as a valuable backup plan for her son’s future, and if her son wished to stay and work in the U.S. after graduation, obtaining a green card through the EB-5 program would significantly ease the process, Luo told Xie. Luo declined Documented’s requests for an interview.

Xie said that Luo also promised her son would receive a green card within two years of the investment and that she could withdraw from the project with a full refund after a 5-year, interest-free period.

In the final stage of reaching an agreement, Luo launched his last push. On November 10, 2015, he sent Xie multiple messages, verified by Documented, through WeChat to reassure her about the deal:

“Don’t worry, you’ll definitely get the green card!”

“Even if the business doesn’t go well, we will sell the property, you’re the first in line to be repaid!”

“Don’t worry too much, it won’t happen!”

“Just wait for the good news!”

Two days later, Xie mortgaged her two-bedroom apartment in Shenzhen and wired $550,000 to Hubei Mayflower Industry and Commerce Group. As part of the EB-5 program, USCIS requires investors to provide clear documentation proving the lawful source of their investment funds, for which Xie said she passed. Her son then signed the limited partnership agreement with Xiaozhuang Ge, president of NYC Mayflower Regional Center, Inc. and also husband of Weihong Hu, according to a contract reviewed by Documented.

Xie said she expected to receive her money back in 2020, five years after her initial investment.

Then she and her son waited. And waited.

Trying to stay optimistic

After years of fruitless waiting, Xie said she contemplated withdrawing from the project and requesting a refund in 2022. Xie was then connected via Luo to the New York contact for the Mayflower Group, Leo Ge, who is Weihong Hu’s son.

Ge was much less responsive than Luo, according to Xie, who said that Ge stopped replying to Xie’s refund requests on WeChat in May of 2023.

Over the nearly ten years of correspondence with both Luo and Ge, Xie said that Mayflower never proactively updated her on the EB-5 Regional Center project’s progress or financial status, despite this being stipulated in the agreement and her repeated requests.

Trying to stay optimistic, Xie told herself, “It’s still early,” knowing that Luo had promised she could withdraw from the project and receive a refund starting in 2020. But when 2020 arrived, her son didn’t receive a green card, nor did she get the promised refund.

What Xie didn’t know was that Mayflower converted the hotel she had invested in into a shelter for released detainees during the pandemic in 2020. She said she only found this out two years later, when she asked Luo how to get her money back after becoming frustrated with multiple failed attempts to get Mayflower to disclose its financial situation, as well as the delays in fulfilling its promises.

By then, Leo Ge finally told her that the company was facing cash flow issues and was in the process of negotiating a shelter contract with the city.

It was the first time Xie had grasped the extent of Mayflower Regional Center’s financial situation. Ge informed her via WeChat that the group was on the brink of bankruptcy and did not have the funds to repay her, according to screenshots of WeChat chat history reviewed by Documented. In the messages, Ge also told her that the company hadn’t repaid the bank principal for two years and hadn’t paid the utility bills for six months.

“The biggest problem now is that the pandemic has disrupted our cash flow,” Ge wrote to Xie in a WeChat message on July 26, 2022, after Xie requested a refund. “My business is on the brink of bankruptcy. Asking for a refund now is impossible; even payday lenders in the U.S. can’t recover money at this point.”

Ge also mentioned to Xie in a WeChat message that the company was in the process of signing a contract with the city to use the property as a shelter. “If we cannot sign a contract, things definitely won’t look good.”

The next day, Ge suggested Xie remain patient and continue with Mayflower’s EB-5 program. He informed her that he planned to hold on until the government rented out Mayflower’s hotel, writing to Xie in a message through WeChat, “I’ll have the cash flow to gradually pay you back. Even if you withdraw now, I don’t have the money to refund you.”

But Ge didn’t mention that the contract was part of the millions of dollars that Hu, his mother and the hotel’s owner profited from through city business involving this facility. Hu had reportedly hosted two campaign fundraisers attended by Adams at the hotel during his 2021 mayoral run.

After Adams took office in January 2022, his administration approved the renewal of Hu’s six-month shelter contract at the Fresh Meadows hotel four times, generating $6.2 million annually for her business.

Additionally, Hu allegedly provided housing at the hotel for Winnie Greco, the mayor’s Asian affairs director and top fundraiser, who recently resigned after being targeted by federal agents, in a taxpayer-funded room for over eight months between late 2022 and early 2023, with costs likely exceeding $50,000. Although the mayor’s press office and Hu’s lawyer told THE CITY that Greco paid for her stay in the Fresh Meadows hotel, none of them provided reporters with receipts to back up their statements.

Ge also didn’t mention that his family was preparing to purchase a new condo in Manhattan soon. Three months after Xie requested a refund, Hu bought a three-bedroom unit in an 88-story luxury building at Hudson Yards for over $5 million in cash in October 2022.

There, Hu hosted another gala fundraiser for Mayor Adams’ 2025 re-election campaign on June 9, 2023. According to an investigation by Documented, THE CITY and The Guardian, three people who contributed to Adams’ 2025 campaign that day alleged that they or their spouses had been illegally reimbursed by Hu’s family for their $2,000 donations.

In January 2023, when Xie once again sought a refund from Ge, he conceded that the earliest repayment could begin in March. However, the repayment was continually delayed, with Ge stating that the company’s funds were tied up. Four months later, Ge advised Xie to stay with the EB-5 program, saying, “This is the last chance. It’s unlikely that we will be allowed to do immigration in the future.”

Also read: Behind a Chinatown Real Estate Deal, a Web of Shifting Alliances and Political Connections

Ge’s response left Xie frustrated and doubtful. “The hotel we invested in is already built, and the five-year interest-free investment period has ended. Year after year, they claim to have no money — where has the money gone?”

Xie said she only learned some vague information from Luo — that Weihong Hu was preparing to open a new hotel in Manhattan. According to her, Luo said that the company’s money was tied up in the project.

Xie submitted a written refund request to Mayflower and notified Leo Ge on June 17, but Ge never responded to her messages.

An insult

Matthew Stock, the director of the Whistleblower Rewards Practice at Zuckerman Law, with no affiliation to Xie, told Documented that promising investors a guaranteed refund is a major red flag for EB-5 programs.

“Any type of guarantee, ever, in an investment is the red flag,” said Stock, emphasizing that no investment is risk-free — especially in the EB-5 program, where investments must remain at risk to qualify for a green card.

Compounding her difficulties, Xie’s father was diagnosed with liver cancer in July, and her mother was hospitalized. Amid financial strain, family caregiving responsibilities, and ongoing disputes with Mayflower, Xie collapsed one day in early August, suffering severe injuries from the fall.

“We are struggling with high medical expenses and I urgently need money,” Xie messaged Luo through WeChat, pressing him to request repayment from Hu.

After over two years of challenging negotiations, Xie finally received $10,000 from Mayflower on Aug. 21. Then, on Oct. 1, she received another $10,000 from the company. However, there were no updates on when she could expect the remaining $530,000 of her investment.

Seeing the amount on the remittance slip, Xie couldn’t believe her eyes. “It is very insulting. After such a long attempt to recover the funds, they only returned this small amount of money.”

Weihong Hu and her lawyer didn’t respond to numerous questions about the transparency of Mayflower’s EB-5 program and her relationship with Chunan Luo. They also did not respond to questions about Mayflower’s financial situation and the reasons for failing to refund Xie as promised.

When Xie questioned Luo about his promise of a refund after five years of investment, Luo shifted the blame to the company and admitted to Xie that he was instructed to make these promises during training conducted by Weihong Hu’s son, Leo Ge, according to WeChat chat history reviewed by Documented.

‘Just the tip of the iceberg’

When she learned about Hu and Adams’ mutually beneficial relationship, Xie was shocked to discover that her investment project was the subject of controversy, including Hu allegedly providing taxpayer-funded rooms seperately to both Greco and Eric Adams’ son, Jordan Coleman, as well as reimbursing donations to contributors of Eric Adams’ mayoral campaign. She was unaware that Hu was the key decision-maker at Mayflower Group and reportedly had a criminal record in China.

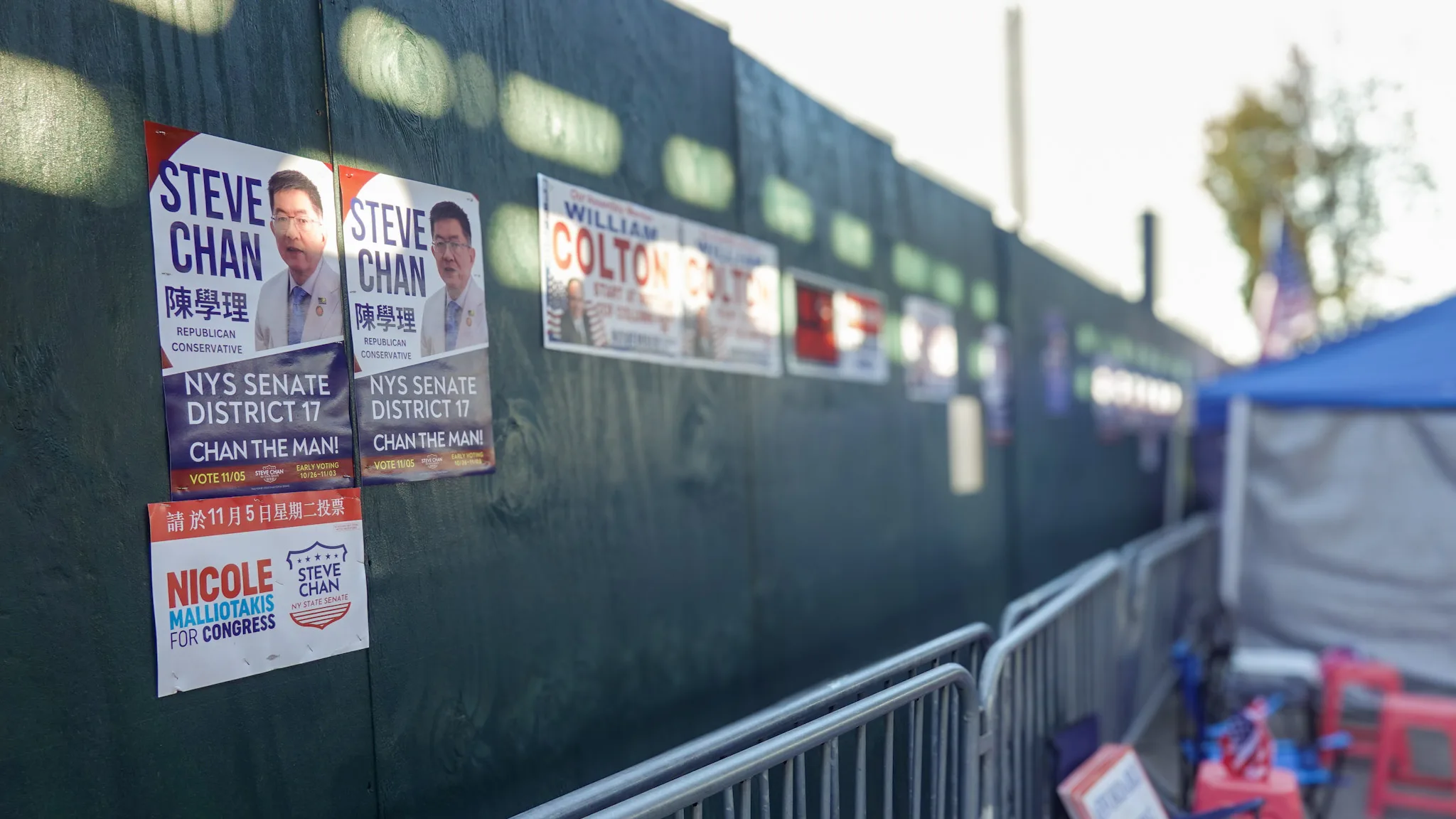

陈学理胜选凸显华人社区“右转”

These facts strengthened Xie’s determination to expose the violations of Mayflower’s EB-5 program and whistleblow to the media. “I’m just one investor of the project, and I don’t know how many others are like me,” she said. “Their [Mayflower’s] illegal chain is just the tip of the iceberg and must be stopped to prevent further societal harm.”

This upcoming November marks the 9-year anniversary of Xie’s initial investment to obtain a green card for her son. Her son missed out on valuable job opportunities and important moments with family while waiting for his immigration status to be changed in the U.S., and they are unable to recover their money when they are in desperate need of it to support their ailing family members.

“What pains me is seeing the clean, hard-earned money of taxpayers and investors being turned into dirty capital and unethical schemes,” Xie said. “U.S. immigration should attract honest, responsible individuals, not people like Hu, who corrupt the system. We cannot let them illegally and unethically damage the social ecosystem. I hope my experience will serve as a warning to the public and law enforcement.”

If you have more information about Mayflower’s EB-5 program, please contact us at april.xu@documentedny.com.