In 2017, Mi Xue started selling braised meat and vegetables at the New World Mall, the most heavily trafficked food court in Flushing, Queens. Chinese immigrants living in and outside of New York turned to her wide and rich selection of products, including river snail, duck neck, tongue and gizzard. To accommodate the demand from out of state, Mi began to experiment with mail orders. At the time, a new online grocer called FreshGoGo was quickly expanding its offerings to include prepared foods from restaurants.

Packaging and labeling nearly 100 food boxes a day took time and energy, and Mi couldn’t always rely on the post office. She resolved to find other alternatives. Mi Xue thought joining the FreshGogo platform would help broaden her reach, spare her the logistics, and allow her to focus on concocting delicious food. When she signed on with the platform in late 2019, it was already one of the largest online Asian grocers in the United States. Soon, FreshGoGo was bringing her 50 to 100 orders a day, making up almost half of her business.

Then the issues began. In early 2021, FreshGoGo’s local manager began pushing Mi to expand her restaurant’s offerings to include signature dishes from her home province of Hunan, China. “He urged me to fill a gap in FreshGoGo’s offering through food from my home,” Mi said. But to her surprise, FreshGoGo asked her to offer a steep discount to promote her new dishes, while the platform withheld payment for the orders that she had already fulfilled.

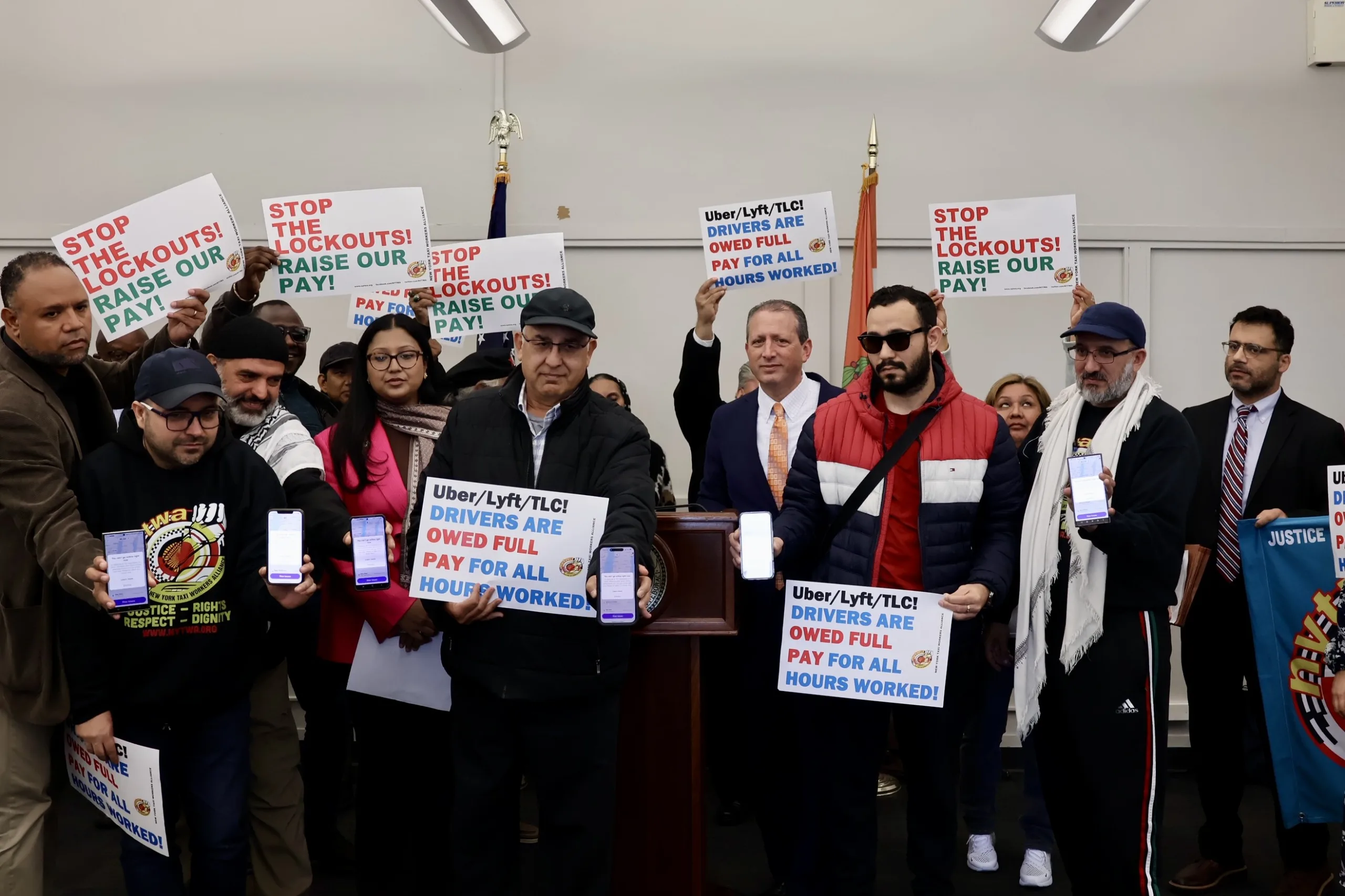

Also Read: Rideshare, Delivery Workers Demand Protections from App Companies

Founded in 2017, FreshGoGo is among the largest online grocers dedicated to Asian food in the United States. The company delivers both groceries and prepared foods from its restaurant partners to 24 states. According to Song Shu, a spokesperson for the company, FreshGoGo owns a delivery fleet equipped with cold chain storage, allowing the grocer to deliver long distances, and giving the company an edge in the increasingly competitive landscape of Asian grocery delivery. Beneath the company’s rapid growth, however, FreshGoGo has been mired in disputes with a number of its restaurant partners over protracted payment cycles.

By August 2021, Mi Xue was owed payment for three months worth of orders; it wasn’t until the company received a fresh injection of capital that they managed to settle their debts. This January, when FreshGoGo withheld Mi’s payments again, the resolution was not as swift. After the amount Mi was owed reached again three months worth of orders, she tried to negotiate a timely payment plan, but was met with a long list of excuses.

“When the payment cycle got to one month, we were still okay with the delay,” Mi said. “When it hit two months, we started to ask around. And then it got to three months and towards the end almost three and a half months. That’s when we could no longer bear the burden anymore.”

She started to experiment with listing on other delivery sites. Then, on January 20 — with some payments as old as four months still outstanding — Mi decided to post her exchanges with representatives from FreshGoGo on the Chinese social media platform, Xiao Hong Shu. She soon received hundreds of comments and likes from concerned customers.

“I thought [FreshGoGo] had already given up on us,” she said, “So I had to find other ways and decided to share my experience with the public.” The unwanted public attention likely contributed to the rapid response from FreshGoGo: four days after her posting, Mi Xue received a preliminary payment plan from the company. Another four days later, she received her first payment in months.

FreshGoGo: A gift and a curse

FreshGoGo currently has between 60 and 70 restaurant partners. It works with a large number of Chinese restaurants in New York City, particularly those run by recent Chinese immigrants in Flushing, who cater to the increasingly diverse Chinese diaspora. Many of them have grown their customer base through online platforms, especially during the pandemic. “FreshGoGo allows us to reach as far as Chicago and Atlanta,” said Da Xiong, owner of Wuhan Foodie, a restaurant specializing in food from Hubei province. “During peak months, nearly half of our orders come from various delivery platforms, mostly FreshGoGo.”

For the company, the growth has come at a cost. To quickly enter new markets, FreshGoGo needs to suffer a period of losses to gain volume and reach profitability. Zhao Yong, founder of the New York and Connecticut-based restaurant chain Junzi Kitchen, said FreshGoGo struggles against better-funded platforms. “Many of FreshGoGo’s competitors are playing the venture capital game and raising a lot more funds, so they can afford to burn money for much longer before becoming profitable,” Zhao said. “FreshGoGo took a much more traditional approach. It’s run by owners of traditional Asian supermarkets.”

Increasingly, the platform’s growing pains have been felt by its restaurant partners. Da Xiong has also experienced delayed payments. The amount reached three months’ worth of orders in late January this year, right before Chinese New Year, leaving him no choice but to pull his restaurant off the platform. After months of negotiations, Da Xiong managed to reach an agreement with FreshGoGo, halving the payment on hold from three to one and a half months. Wuhan Foodie went back on the platform in February.

FreshGoGo said the payment delays were caused by a huge increase in orders during the pandemic, and blamed some restaurants for working with other platforms, breaking the exclusivity agreement they had signed with FreshGoGo.

Mi Xue felt that FreshGoGo’s claim was unfair — she only advertised her food on competitors of FreshGoGo, because of FreshGoGo’s payment delays last year, she said. Da Xiong also argued that payment for orders fulfilled should not be tied to whether restaurants complied with their exclusivity terms.

Not everyone has been as vocal, or able to negotiate. Huge discrepancies exist in how FreshGoGo deals with each restaurant. Right next to Da Xiong’s restaurant is The Old Captain, which specializes in fish dumplings from Shandong Province, and was one of the first restaurant partners recruited by the online grocer’s website. It’s been eight months since the restaurant had its first issue over a payment with FreshGoGo, said Jenny Wang, a co-owner of the restaurant. In 2019, as their contract neared renewal, FreshGoGo pushed to include exclusivity terms, but Wang and her co-owner decided against it. Like many of its peers, The Old Captain has been dealing with a sharp increase in ingredient and wage costs. In December, the couple delisted their restaurant from FreshGogo, after the delay in payments further tightened the restaurant’s liquidity.

Some restaurateurs have adopted a more radical approach by avoiding platforms altogether. At the recently-opened Flushing restaurant Bao Bu Tong, owner Yidi Zhao has personally delivered food by driving his SUV to Manhattan on a regular basis. Every order is placed, coordinated, and fulfilled in group chats hosted on WeChat. “It doesn’t matter the platform. They all charge at least 20 percent on top of other fees. The math just doesn’t make sense to me,” Zhao said.

The resource constraints on both ends of the partnership means that making concessions becomes a daily reality for both restaurants and platforms, but how the burden is shared has been largely driven by individual negotiations. Fearful of slipping into a stalemate, or bankrupting the delivery platform by suing FreshGoGo and destroying any hope of getting their money back, restaurants have had to walk a delicate line. As Wang put it, echoing an old Chinese saying: “Harmony brings wealth.”

Earlier this year, Mi Xue stopped working with FreshGoGo, exhausted from the months-long journey to resolve payment issues. In its place, she started working with Yun Ban Bao, another delivery platform dedicated to Chinese food, whose geographic coverage is limited to a few states around New York — but pays her on time. “Over time I have gained a lot of fans from out of state, and I want to find a way to serve them consistently,” said Mi.