These informational materials are not intended and should not be taken as tax, financial, or legal advice. This list provided by the IRS has trusted partners that can help you file your tax return for free.

The Internal Revenue Service (IRS) requires any person who earns money in the United States to file a tax return every year. This includes immigrants, regardless of their immigration status. However, filing taxes can be confusing for individuals who work in the cash economy.

Documented has received multiple questions from members in our WhatsApp community who asked:

How to file a tax return if you have no records of cash income

Here is what you need to know.

In summary:

- You will need a Social Security Number (SSN) or an Individual Tax Identification Number (ITIN)

- Those who work in the cash economy are often considered independent contractors, and are responsible for keeping records of their earnings

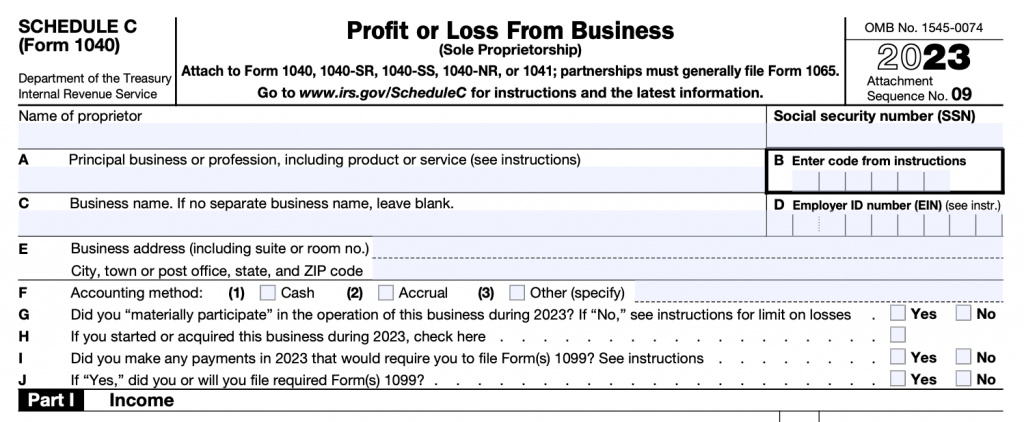

- Individuals who did not receive a W2 or a 1099 form from their employer, must file Schedule C – this form calculates the profit and losses of a business, or an independent contractor

- Schedule C must be filed along with Form 1040

- These IRS trusted partners can help you file your tax return for free

- NYC Free Tax Prep: Where Immigrants Can Get Help Filing

The IRS requires all forms of income, including cash payments, to be reported. Usually, during tax season, a W-2 form is given to employees by their employer to report income and compensation earned during the tax year. For contract or freelance work, form 1099 is often provided.

For tax filing purposes, individuals who were paid in cash, and who did not receive any of the forms mentioned in the previous paragraph, are considered independent contractors.

In order to report their earnings and losses, then they must file a special form known as Schedule C. Schedule C can also be combined with other forms of income, such as a W2 or a 1040, and it is not limited to individuals who solely earn cash.

How is scheduled C used to report cash earned income?

Schedule C is a form that self-employed people use to tell the government about the money they made from their business and the expenses they had while running it. You do not need to have a registered business to file the form.

The form allows you to report cash income, by clicking the box “cash” in line F.

And then proceed to fill up the information in the form, including a total of all the income you earned in cash. It is important to have all the records that show the amounts that you were paid in cash, such as receipts, screenshots, deposits, etc.

Schedule C also allows you to deduct any expenses, such as office supplies purchased, or car and truck expenses used in the services you rendered. Once you have the form completed, transfer the amounts to Form 1040 (U.S. Individual Tax Return Form) and calculate the amounts. Here is a step by step guide on how to fill out Form 1040.

Note: because you earned cash, and no taxes were withheld during the year, there is a chance you might owe the IRS.

Can filing my taxes help with my immigration case?

Filing taxes can be beneficial for adjustment of status in the United States, as it can help individuals demonstrate financial stability and compliance with tax laws. Additionally, a tax return can be shown as proof of address, proof of income, and open the door for other tax credits and benefits.

For assistance, read our guides relating to taxes:

- NYC Free Tax Prep: Where Immigrants Can Get Help Filing

- How to File Personal Income Tax in New York City

- NYC Taxes Benefits Guide: Tax Credits and Deductions

- ITIN Number: Another Way To Pay Taxes As An Immigrant

This list provided by the IRS has trusted partners that can help you file your tax return for free.